What Happens When You Put a Car Through the Business?

When a company buys a car and makes it available to a director or employee for personal use, this triggers a Benefit-in-Kind (BIK) tax charge.

The BIK is calculated based on:

- The original list price of the vehicle (not the price you paid)

- The CO₂ emissions of the car

This charge is added to your personal income and taxed accordingly, making it a potentially expensive perk — unless you choose wisely.

When Putting a Car Through the Company Makes Sense

The best-case scenario? You go electric.

Why Electric Cars Win:

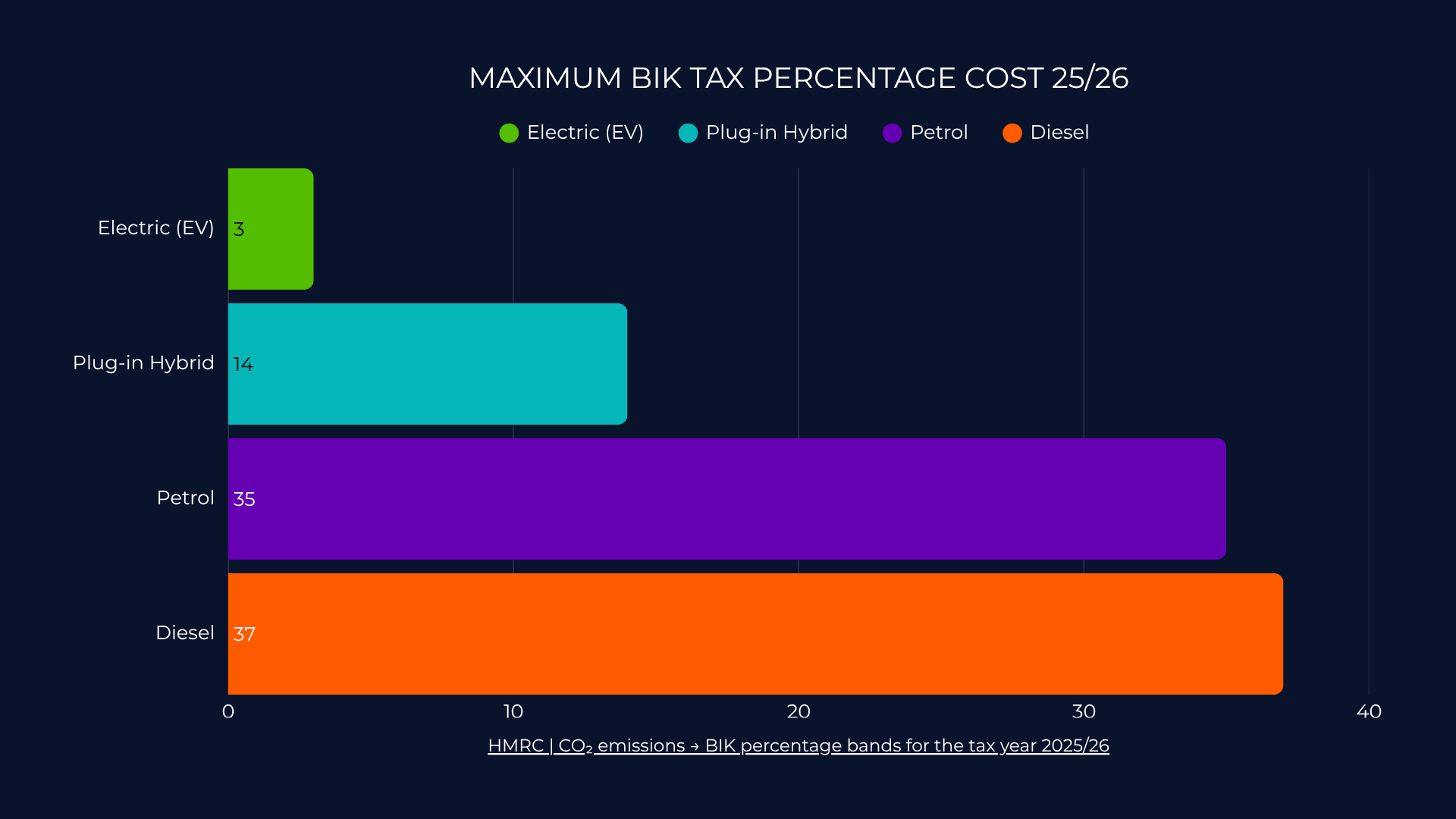

- Low BIK rates – In 2025, electric vehicles (EVs) still benefit from preferential tax rates

- Capital allowances – You may be able to write off 100% of the car’s value against company profits in the first year

- Company image – Eco-conscious branding benefits

If you’re eyeing a Tesla, Polestar, or another fully electric vehicle, putting it through the company could offer serious tax savings.

When You’re Better Off Owning the Car Personally

For petrol, diesel, or hybrid vehicles, the picture changes.

These typically attract much higher BIK charges, which could add thousands of pounds to your personal tax bill annually. That means the tax cost of driving a company-owned hybrid SUV could outweigh the financial benefits.

In these cases, the more efficient route is:

- Buy or lease the vehicle personally

- Charge your company mileage at the approved HMRC rate

You can claim:

- 45p per mile for the first 10,000 business miles

- 25p per mile after that

These payments are tax-free and can be a smart way to offset costs.

Real-World Scenarios

Example 1: Electric Car Win

Sophie, a tech startup founder, buys a £40,000 electric car through her company.

- BIK value: £1,200

- Her income tax rate: 20%

- Tax cost: £240 for the tax year 2025/26

- Capital allowance: £40,000 deducted from profits

Net benefit: Major tax saving and cost-effective driving.

Example 2: Diesel Car Loss

James, a construction business owner, wants a diesel SUV worth £50,000.

- BIK rate: 37%

- BIK value: £18,500

- Tax at 40%: £7,400/year

Net result: Huge personal tax bill, with little offset, bad move.

Key Considerations Before You Decide

- What type of car is it? Only fully electric vehicles truly benefit from low BIK.

- How long will you keep it? Company car schemes work better with longer use.

- What’s your personal income tax rate? The higher it is, the more BIK hurts.

- Do you need to reduce company profits? Capital allowances can help.

Talk to Our Business Tax Experts Today

Book a call today: www.nuvo.co.uk/discovery-call/

This isn’t a decision you should make alone. One wrong move could cost you thousands in unexpected tax charges.

Our team of expert business and tax specialists can:

- Assess your company’s financial position

- Compare personal vs. business ownership costs

- Recommend the most tax-efficient path for you