Prerequisites Before You Start

- You must be registered for MTD VAT with HMRC

- Your accounting period must be due

- You need an MTD-compliant software like Xero or FreeAgent connected to your HMRC account

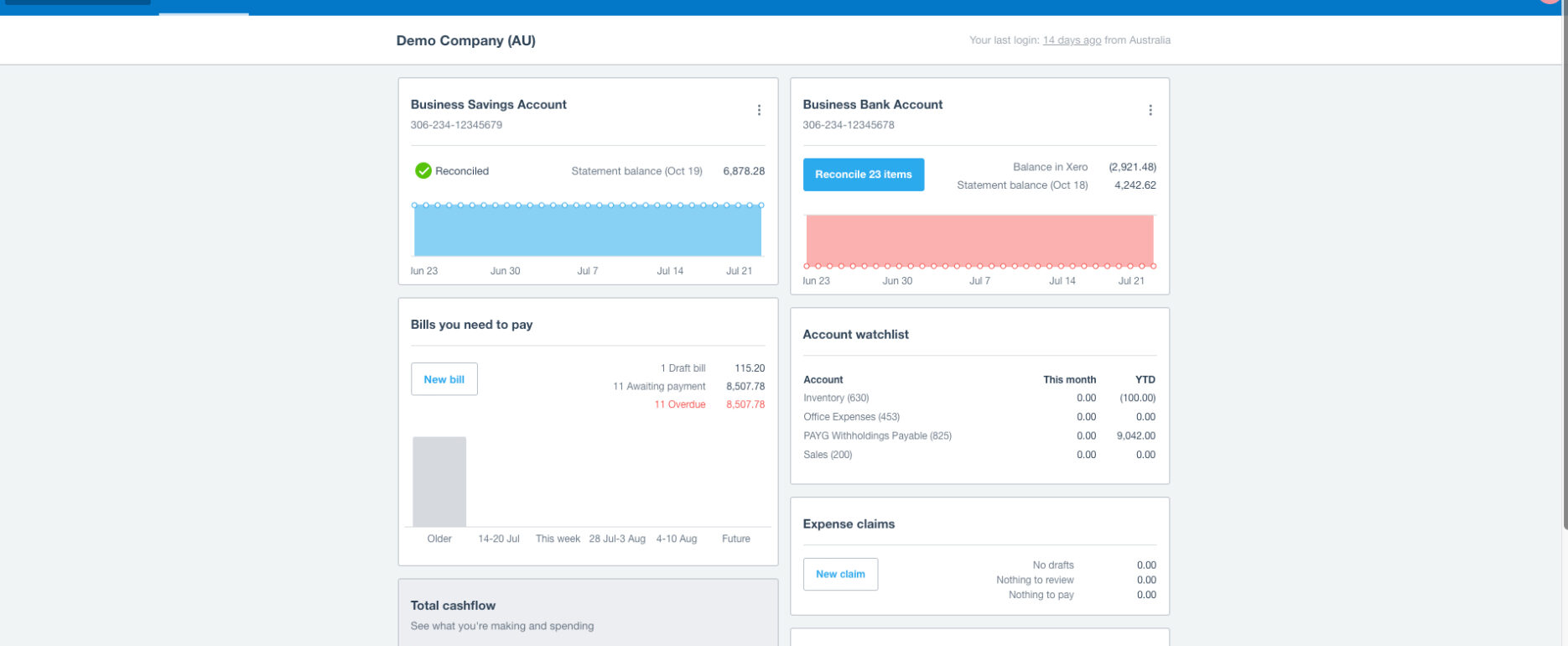

Step-by-Step Using Xero

- Login to Xero and open your VAT Return section

- Click “Prepare VAT Return”

- Xero automatically pulls data from your digital records

- Review the figures, adjust if necessary

- Click “File with HMRC”

- Enter your HMRC login credentials (once)

- Submit and save your confirmation receipt

Tip: Xero also lets you schedule reminders so you never miss a submission deadline.

Step-by-Step Using FreeAgent

- Log into FreeAgent

- Navigate to Taxes → VAT

- Select the VAT period you want to file

- Review all transactions and categories

- Confirm the accuracy of your data

- Click “Submit to HMRC” (after enabling MTD settings)

- Receive your confirmation email and save it

FreeAgent is particularly handy for landlords thanks to its built-in property income features.

Know Your VAT Deadlines

VAT returns are typically due:

- 1 month + 7 days after the end of your VAT period

- For example: Q1 ends 31 March → VAT due by 7 May

Bonus: How to Register for MTD VAT with HMRC

If you haven’t yet registered for MTD VAT:

- Go to GOV.UK’s MTD VAT registration

- Sign in with your Government Gateway ID

- Enter your VAT number and business info

- Wait for confirmation (usually a few days)

Once confirmed, your software can connect with HMRC’s system.

Final Word: MTD VAT is Easier Than You Think

Submitting VAT returns via MTD isn’t scary, it’s smoother, faster, and far less error-prone when using the right tools.

Whether you choose Xero for its intuitive UI or FreeAgent for its landlord focus, you’re building a tax process that works for you.

Need help getting started? Contact Nuvo and we’ll walk you through setup, training, and submission.